what taxes do i pay after retirement

Your entire benefit from a taxed super fund which most funds are is tax-free. Web Part is tax-free made up of.

Web The IRS will withhold 20 of your early withdrawal amount.

. Some of the taxes assessed while working will no longer be paid in retirement but other taxes will still be due. Open an Account Today. Web First assuming the money is in a pre-tax retirement account like a traditional IRA or 401k plan youll be on the hook for income taxes for any money you withdraw.

Depending on your annual. Financial Considerations of Working After Retirement Returning to work is a unique personal decision. If youre age 55 to 59.

Web Taxes on Pension Income. However there are narrow exceptions to paying Social Security taxes that apply at any age such as an individual who qualifies for a religious exemption. No More Payroll Taxes.

Tax-free you dont pay anything more. Pensions Social Security. Web Youll also have to pay state and local income taxes depending on where you live and work on your new income.

There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will ultimately owe 20 of your income or not. TD Ameritrade Offers IRA Plans With Flexible Contribution Options. If youre age 60 or over.

The taxes that are due reduce the amount you have left to spend. Taxes in Retirement Are More Visible. But Social Security and Medicare taxes are only withheld from earned income such as wages.

Web Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. Ad Experienced Support Exceptional Value Award-Winning Education. For most workers thats 62 percent Social Security and 145 percent Medicare of your gross earnings out of every paycheck.

When youre ready to apply for retirement benefits. Web Unlike certain types of income such as qualified dividends or long-term capital gains no special tax treatment is available for pension income. Under current law for 2018 the seven tax rates that can apply to ordinary income including pension income are 10 12 22 24 32 35 and 37.

Your 401 k plan may offer you the opportunity to have taxes automatically withheld from a withdrawal. Web Your 401 k contributions are put in before taxes have been paid and they grow tax-free until you take them out. Tax Planning Should Be a Big Part of Your Retirement Plans.

24 Tips for Keeping More of Your Own Money. A Roth 401 k or traditional 401 k may be a better option if youd prefer to pay taxes now and enjoy tax-free distributions at retirement. The only exception occurs in states without an income tax.

Web You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Rolling over the portion of your 401 k that you would like to withdraw into an IRA is a way to access the funds without being. Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item 2.

Web Throughout your working years youve paid payroll taxes for Social Security and Medicare. File a federal tax return as an individual and your combined income is between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits. The rest of the amount will be withheld for taxes.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax-deferred annuitiesin the year you take the money. One of the main taxes thats no longer paid in retirement is payroll taxes or the self-employment tax if. Ad Download The Definitive Guide to Retirement Income from Fisher Investments.

When you take distributions the money you take each year will be taxed as ordinary income. Your income payment has two parts. Web The short and general answer is yes individuals and couples generally have to pay taxes in retirement.

Web Retirement Planning and Your Taxes. Web Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the funds. Taxable taxed at your marginal tax rate less a 15 tax offset.

Fisher Investments shares these 7 retirement income strategies to help you in retirement. For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000. Web What is the tax rate on 401k withdrawals after retirement.

The IRS will penalize you with a 10 penalty on the withdrawal amount when you file your tax return.

Tax Filing Tips For Saving Money On Your Taxes Filing Taxes Free Tax Filing Money Saving Tips

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Top 3 Benefits Of Roth Ira Individual Retirement Account

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

What Are Defined Contribution Retirement Plans Tax Policy Center

The Best Retirement Vehicle You Ve Never Heard Of Www Americanwealthonline Com Ratho Reis Manager Ratho Awg Gma How To Plan Retirement Planning Retirement

State By State Guide To Taxes On Retirees Retirement Retirement Income Tax

See How Each State Taxes Retirees In Our State By State Guide To Taxes On Retirees Social Security Benefits Social Security Social

Here S Why Some Retirees No Longer Have To File A Tax Return Retirement Money Social Security Benefits Retirement Retirement Benefits

Vanguard Consider The Advantages Of Roth After Tax Contributions

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

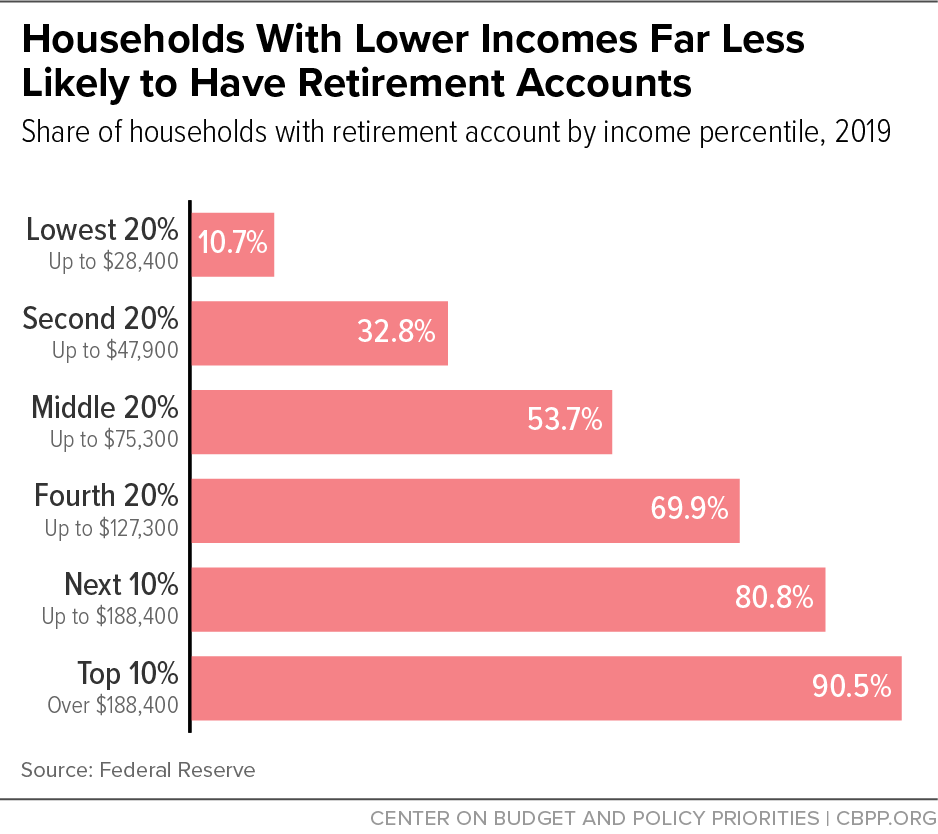

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

9 States That Don T Have An Income Tax Income Tax Income Tax

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age